crypto tax calculator canada

It takes less than a minute to sign up. Home Search results for crypto tax calculator canada How to Calculate Capital Gains on Cryptocurrency.

Best Crypto Tax Calculator Canada In 2022 Skrumble

This difficulty in calculating the taxes is what brought about the use of tax calculators.

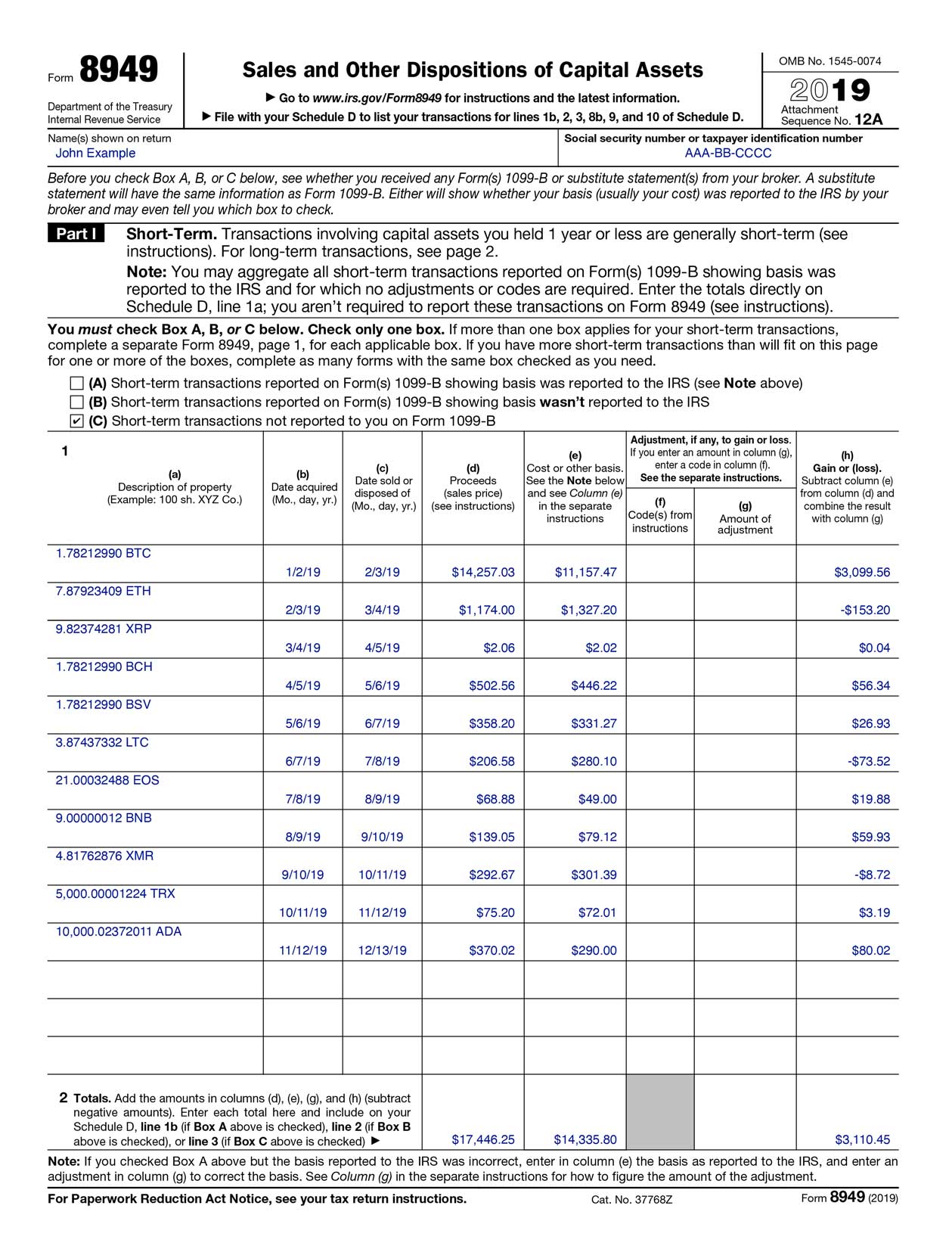

. If for instance you earn 1000 through crypto trading and your tax rate is 25 youll end up with a tax bill of 125 on those funds or 25 of 500. On the crypto transaction of 20000 you will pay tax on 10000 at a rate of 33. Crypto Tax Calculator.

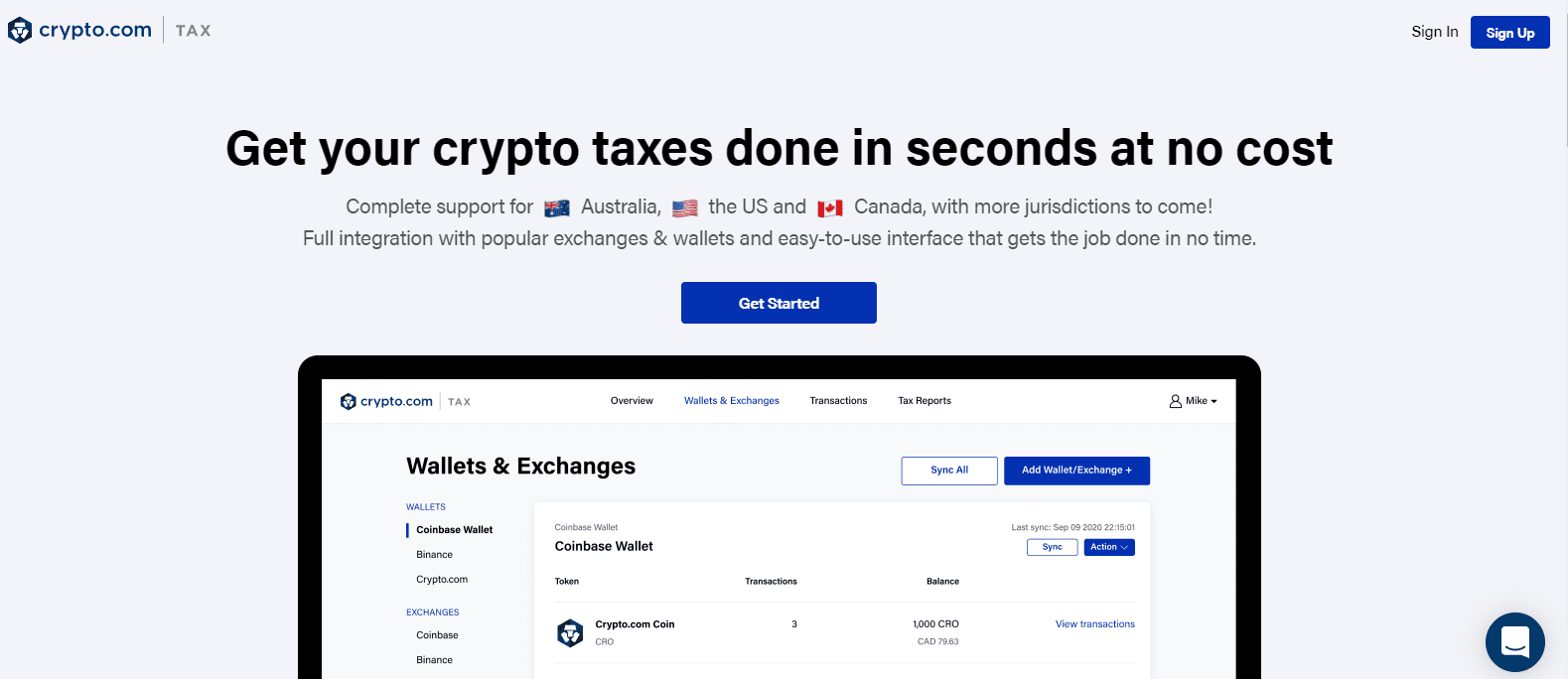

Crypto Tax Calculator Use our calculator to get an estimate of the taxes on. The free trial allows you to import data review transactions. From a peak in November 2021 of nearly US70000 for one unit bitcoins value has been cut by more than half to about US30000 currently.

Koinly calculates your crypto taxes and helps you reduce your tax bill no matter if you need to report business. Sort out your crypto tax nightmare. Crypto tax calculators like CoinLedger can help you generate a comprehensive tax report in minutes.

However it is important to note that only 50 of your capital gains are taxable. For income tax purposes cryptocurrency isRead more. Create your free account now.

However it is important to note that only 50 of your capital gains are taxable. You would pay it in dollars not in crypto. Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance.

Koinly is one of Canadas most popular crypto tax calculators. Ethereum Solana and more. The broader cryptocurrency market has similarly.

A simple way to calculate. Despite crypto tax calculators being created to make tax calculation easy not all of them are effective. Using Your Tax-Advantaged IRA Trade 200 digital assets like Bitcoin Ethereum and Solana.

Supports DeFi NFTs and decentralized exchanges. This would mean you pay 3300 tax on your gain of 20000. Heres how you calculate crypto taxes in Canada.

Remember how we said Canada taxes only. By sdg team Tax. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity.

FMV Fair Market Value Cost Basis Capital GainsIncome Fair market value is the amount the asset or crypto is selling for. Calculate your crypto taxes and learn how you can minimize crypto taxes for the USA UK Canada and Australia. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity.

NFT Support Track all of your NFT trades. Remember the calculator featured above is a simplified version to give a rough. Bitcoin Tax Calculator for Canada.

We offer a free trial so you can try out our software and get comfortable with how it works. February 12 2022 by haruinvest. What is covered in the free trial.

Cryptocurrency Tax Software Cryptotax Com

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Crypto Tax And Portfolio Software Cointracker

Bitcoin And Taxes When Do You Have To Pay Taxes On Bitcoin

How Is Cryptocurrency Taxed In Canada Money We Have

![]()

Cointracking Crypto Tax Calculator

Koinly Review What You Need To Know About This Crypto Tax Calculator

![]()

Cryptocurrency Taxes In Canada Cointracker

How Does Germany Taxes Crypto How Much Tax Do You Pay On Crypto In Germany Is It Really Tax Free

Crypto Com Tax Tool Review 2022 Free Tax Calculator By Crypto Com

6 Best Crypto Tax Software S 2022 Calculate Taxes On Crypto

Cryptoreports Google Workspace Marketplace

Crypto Taxes In Canada Adjusted Cost Base Explained

Crypto Com Tax The Best Free Crypto Tax Bitcoin Tax Calculator

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

Best Cryptocurrency Calculator Mining Profit Taxes

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker